-

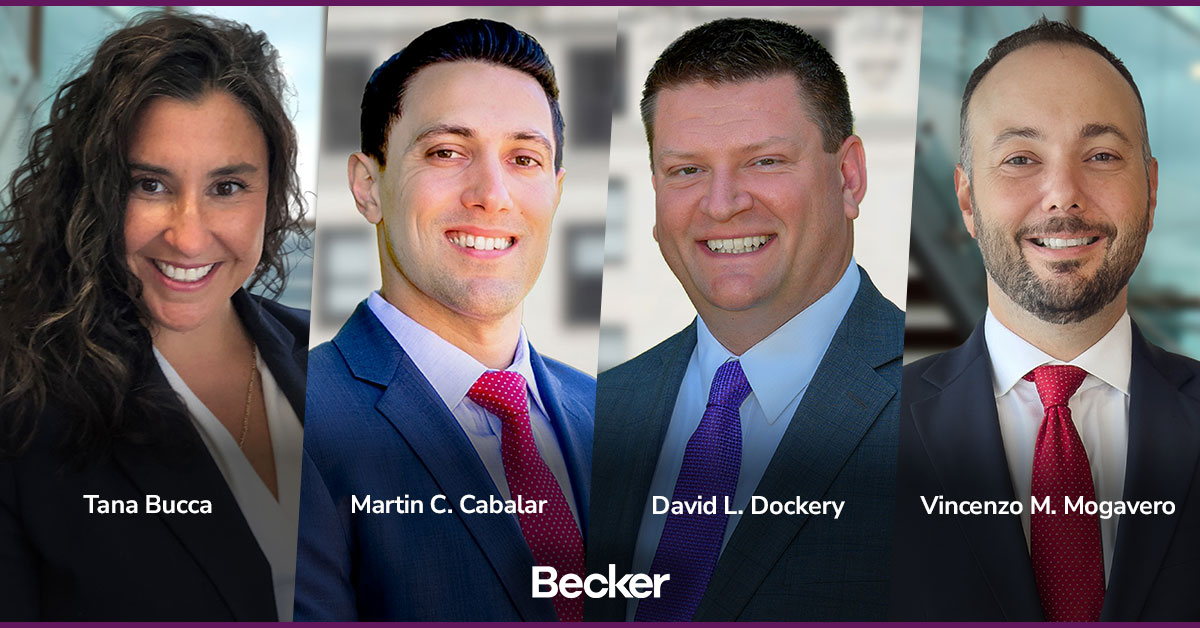

Becker Announces New Leadership For New Jersey Condo, Co-Op & HOA Practice

Morristown, NJ – May 23, 2025 — Becker, a multi-practice commercial law firm with atto...

May 23, 2025 -

Ronald Perl Receives Community Associations Institute’s Distinguished Service Award

Morristown, NJ – May 9, 2025 –Becker, a multi-practice commercial law firm with attorn...

May 9, 2025 -

Can My Co-op Charge Me Extra for Renting Out My Unit?

Q: I bought a co-op apartment in Queens about 35 years ago and I’ve been renting it out....

May 6, 2025

Becker is a multi-practice commercial law firm with attorneys, lobbyists and other professionals at offices throughout the East Coast.